Source: Oxford Economics

Global: The economic cost of coronavirus lockdowns

- Widespread lockdowns and social distancing in economies affected by the coronavirus outbreak are set to cause a massive negative short-term impact on consumer spending and GDP. A large chunk of consumer spending is discretionary and so is very sensitive to being postponed or lost completely due to quarantines and social distancing.

- The early evidence from China supports the idea that up-front effects will be large, with retail sales down 20% year-on-year in January-February and industrial output over 13% lower, thanks to widespread factory closures. Sectoral indicators in advanced economies point to huge declines in activity in sensitive areas.

- We estimate that a three-week lockdown affecting 50%-90% of a population would cut consumption in the three-month period featuring such a lockdown by 5%-8%, a six-week lockdown would cut consumer spending by 9%-16%, and a 12-week lockdown would slash it by 18%-32%.

- Full-year effects depend on how quickly postponed consumption revives as outbreaks come under control. But even quick recoveries imply big full-year losses: An initial 18% slump in consumption would still imply a full-year loss of 9%, even if spending recovered to pre-pandemic levels in four quarters. If recovery took eight quarters, the full-year loss would be an enormous 14%.

US: Congress to deliver an essential $2tn coronavirus lifeline

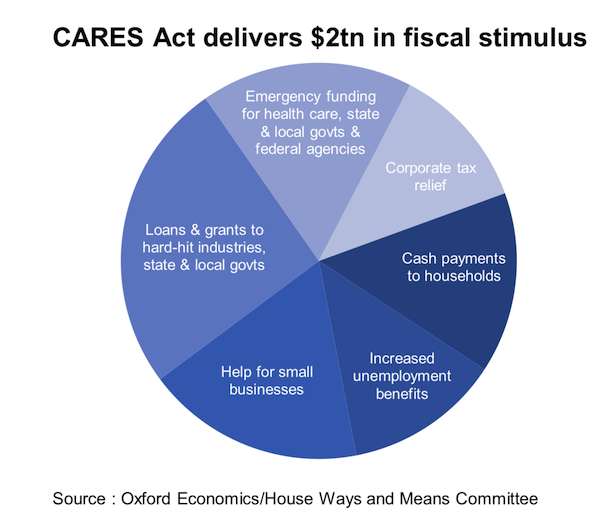

- The $2tn US stimulus package, the Coronavirus Aid, Relief, and Economic Security (CARES) Act, provides fiscal stimulus, loans, and loan guarantees amounting to 9% of US GDP.

- With partial lockdowns across the United States leading to a sudden stop in economic activity, the US will experience the largest economic contraction on record with the most severe surge in unemployment ever. The latest stimulus measures will reduce the risk of an even deeper depression in activity and employment and support a post-virus rebound in activity — but it won’t prevent the ongoing recession.

- The three-pronged CARES Act will support households via direct checks to low- and middle-income families along with an expansion of unemployment benefits. It will support large and small businesses via nearly $1tn of loans, loan guarantees, and bailout funds. And it will provide new funding for hospitals, state and local governments and a myriad of federal agencies.

- Given the lack of details and foresight surrounding the take-up from lending programs, it is not possible yet to quantify the net budget impact of the CARES Act. However, since nearly half of the funding is toward lending facilities, the budget shortfall will be much less than 9% of GDP.

- We caution against the misguided notion that the programme can be leveraged to provide a $6tn stimulus to the economy. The size of the leverage is a function of credit-loss provisions so that the program acts more as a floor preventing an economic collapse rather than providing a pure boost to activity.

Eurozone: Solid initial fiscal response now needs a follow-up

- As the fallout from coronavirus plunges the eurozone into recession, fiscal support will be vital to prevent the sharp downturn from causing permanent economic scars. National governments have moved relatively quickly to promise large fiscal packages, averaging 11% of GDP in the biggest European economies, with Germany going the furthest so far.

- While this appears sizeable, most of the support is credit guarantees, so we think much greater actual fiscal stimulus will be required.

- Eurozone governments initially focused on providing resources for healthcare, followed by liquidity for businesses, and have only now started on actual stimulus measures. Income subsidy schemes are common and seem appropriate given the concentrated nature of the shock on vulnerable sectors, e.g. tourism, where solvency will quickly become an issue.

- However, we think even more fiscal stimulus will be needed to jump-start the recovery in H2 once containment measures are lifted. Some governments have already hinted that they will ramp-up spending, so others may match the size of Germany’s package in the coming days. Ultimately, the required response will depend on the length of containment and the pace at which economic activity can resume – both still highly uncertain.

Germany: Berlin protects the economy with a €1 trillion shield

- The German government has massively scaled up and widened the scope of its fiscal response to the coronavirus outbreak. The package aims to protect the economy with a shield that is sufficient to withstand even a plausible adverse scenario. At over €1tn, or over 30% of GDP, the package is now one of the largest around the world and the largest in the country’s history.

- The package is focused on measures to protect firms’ liquidity with guarantees on loans by the KfW (Germany’s state-controlled development bank) to smaller firms raised to €822bn from €465bn, which can be boosted to €1.1tn. It has also added €400bn of guarantees for larger firms. This could cover two-thirds of non-financial firms’ existing loans.

- Of immediate importance is the widening in the package’s scope. A new rescue fund will be able to inject equity of up to €100bn to ensure the solvency of key firms. Also, the supplementary budget, which could widen the fiscal deficit to a new record of 4%-5% of GDP, contains €50bn for direct transfers to sole traders and very small firms. This adds to the existing income support via ‘Kurzarbeit’.

- The government has assumed a 5% GDP contraction in 2020. This is a very plausible downside scenario to our new forecast of a 2% drop, and should protect the fiscal package from needing an immediate re-adjustment if the containment measures are prolonged or expanded in the coming weeks.

Coronavirus vulnerability update for EU27, UK, and EEA

- The coronavirus epidemic continues to spread throughout Europe and will badly hit all economies. After gauging the economic vulnerability of eurozone countries to containment measures in a prior note, we extend our vulnerability scorecard for the EU27, the UK, Norway, Iceland, and Switzerland.

- It remains the case that first-order economic impacts will be determined by the scale of each country’s containment measures, which have become increasingly severe over the last few days. But beyond this, second-order effects will be determined by each country’s structural economic vulnerability to the outbreak, which we find varies widely.

- We assess a range of structural factors including sectoral compositions, firm size distributions, demographics, and health sector capacity. We find most Northern European as well as the German and French economies look better-positioned to weather the economic shock.

- Even after extending our scorecard, countries in the eurozone periphery remain among the most vulnerable. The Southern eurozone economies also tend to have the least policy space to respond and are in weaker cyclical positions. This reinforces the need for coordinated European fiscal policy.

EM coronavirus rankings – bad for all, awful for some

- The COVID-19 pandemic will badly hit all emerging market economies. Limitations in health care, fiscal buffers, and economic structure typically make EMs more vulnerable to major external shocks. Our scorecard ranks EMs accordingly and predicts that Latin American and African regions will be worst affected.

- LatAm and Africa have relatively poor health systems, weaker fiscal positions, and greater dependence on commodities. Bolivia, Costa Rica, Nigeria, Peru, South Africa, and Egypt score particularly badly.

- European EMs appear least vulnerable overall but still seem weak on some key metrics. They have large elderly populations and are likely to have their high female labour participation threatened by additional child care demands.

- Asian EMs suffer relatively stretched health care and broadband capacity.

India: Growth heads into ‘sudden stop’ following lockdown

- On 22 March, India put 75 districts, across 20 states and 2 union territories, under lockdown until the end of the month as it ratcheted up its response to the coronavirus outbreak.

- Several states also imposed additional restrictions.

- We estimate that this could hit Q1 2020 GDP to the tune of $6.5-7bn and lower our Q1 growth estimate to 3% y/y from 4.3% earlier. A substantial downward revision to our full-year forecast is also likely.